Online homes credit knocking on the door

Shenzhen residents trapped in the city's skyrocketing housing market but determined to chase after their "dream homes" have found some solace.

Several Internet financing platforms have sprung up offering loans for those who are still scratching their heads when it comes to making a down payment.

But market experts have warned of the "huge potential risk" in taking up such loans as Shenzhen's real-estate market is already seeing a high leverage ratio.

One loan product offered by Souyidai.com - an Internet financing website run by the Sohu Group - promises a credit line of up to 20 percent of an apartment's down payment, or 5 million yuan ($760,000).

The repayment period ranges from three months to three years and the lowest monthly interest is 0.5 percent.

According to current regulations, buyers need to fork out at least 30 percent of an apartment's price as down payment. The interest rate on a public accumulation funds' loan is 2.75 to 3.25 percent and more than 4.35 percent for commercial loans.

By comparison, Internet loans are attractive to borrowers although the mainland's central bank had lowered interest rates five times last year.

The catch is that an Internet loan is packaged as an investment product for investors online, with an annualized return of 8 to 10 percent, creating a potential risk for both the finance and property markets, warned Lin Na, a representative of the Guangdong Provincial People's Congress and a manager at Ping An Bank.

Lin said such loans are turned into a P2P (peer-to-peer) finance product but, at the same time, the source of a housing loan's down payment has been changed from traditional banks to online individuals.

She expressed concern that the entire industry's capital chain will be cut off once such investment products cannot be cleared. In addition, it will also aggravate speculative activity in Shenzhen's homes market.

The city's property prices have been going up for 15 months, noted Wang Fei, director of the Centaline Property Research Center in Shenzhen.

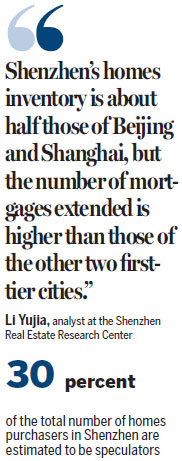

She cited the market's high leverage ratio as a key factor for the upward trend, saying that speculators account for about 30 percent of the total number of homes purchasers.

Wang said 2015 had seen the most relaxed policies for credit and loans in Shenzhen's history, and it's not likely to be repeated this year.

Media reports said four major national banks in Shenzhen have tightened up their loan policies for employees in real-estate agencies after they were found to be the main speculators. But the banks denied the reports.

Li Yujia, an analyst at the Shenzhen Real Estate Research Center, believes the market will benefit if banks tighten their credit policies because that would mean that risks in the real-estate market have become distinct and precautionary measures would be needed.

According to Li, Shenzhen's homes inventory is about half those of Beijing and Shanghai, but the number of mortgages extended is higher than those of the other two first-tier cities.

grace@chinadailyhk.com

(HK Edition 01/29/2016 page8)

Print

Print Mail

Mail